In relation to preserving your economic future, amongst the neatest things you can perform is to seek correct insurance suggestions. Coverage is sort of a security Internet that will capture you in case you slide, but understanding tips on how to choose the proper insurance policies might be a frightening endeavor. With a lot of solutions available, it's easy for getting overwhelmed. The important thing is to be familiar with your preferences and obtain pro assistance that matches your specific condition. Permit’s dive into why fantastic insurance plan information is essential for your assurance.

Coverage tips is more than simply shopping all over for the cheapest amount. It’s about knowing the differing types of coverage out there and working out which ones take advantage of perception for the Life style and financial targets. Irrespective of whether it's well being insurance plan, residence insurance plan, auto insurance, or everyday living insurance policy, the recommendation you receive really should allow you to keep away from prevalent pitfalls and make sure you’re protected whenever you need to have it most. The appropriate tips can help you save funds, time, and a lot of stress in the future.

One of several first factors insurance plan assistance can do for you is help you recognize the differing types of protection. Insurance policies isn’t a one-measurement-matches-all Alternative. What performs for another person might not be well suited for you. As an illustration, health and fitness insurance policy may differ greatly dependant upon your age, professional medical history, and household problem. Equally, life insurance policies might vary according to no matter if you’re single, married, or have young children. Fantastic advice will guide you thru these options, ensuring that you select the coverage that finest matches your requirements.

The Main Principles Of Comprehensive Business Insurance Solutions

The most forgotten facets of coverage is comprehension the wonderful print. Many people basically Select The most cost effective policy without completely comprehension the conditions and terms. This can result in disappointment any time a claim is denied or only partly paid. Insurance policies assistance will help you see The larger photograph by outlining the main points, exclusions, and constraints of each and every coverage. A experienced advisor will be sure to’re not still left in the dead of night when you have to come up with a assert.

The most forgotten facets of coverage is comprehension the wonderful print. Many people basically Select The most cost effective policy without completely comprehension the conditions and terms. This can result in disappointment any time a claim is denied or only partly paid. Insurance policies assistance will help you see The larger photograph by outlining the main points, exclusions, and constraints of each and every coverage. A experienced advisor will be sure to’re not still left in the dead of night when you have to come up with a assert.Whenever you’re striving to save cash, insurance policy can from time to time look like an avoidable expense. On the other hand, without the need of proper insurance policies, you’re leaving you subjected to large financial dangers. Picture a hearth destroying your home or an automobile accident leaving you with serious health-related bills. With no right coverage, you could potentially be experiencing yrs of debt. That’s why trying to find insurance plan guidance is an investment with your long-time period monetary security. A great advisor will let you stability Value and protection, ensuring you’re not overpaying for cover you don’t have to have although even now getting adequately insured.

Insurance coverage guidance can also assist you to navigate the complexities of choosing among distinct vendors. Each individual insurance provider features a number of procedures, each with distinctive Advantages, exclusions, and premiums. Sorting through all the choices on your own can feel overwhelming, but with Expert tips, it is possible to confidently decide on the most suitable choice. A very good advisor will Examine many providers, demonstrate the variances, and make tips based on your personal circumstances. This will save you time and Electricity, enabling you to make knowledgeable decisions.

The value of insurance policy suggestions will become even clearer once you encounter a lifestyle-modifying party. No matter if it’s purchasing a dwelling, getting married, getting a little one, or retiring, your insurance policy needs alter eventually. An important everyday living function may possibly involve you to update or swap procedures. One example is, after receiving married, you would possibly require to alter your well being insurance policies or lifestyle insurance coverage insurance policies to incorporate your husband or wife. Insurance coverage tips will help you make these transitions easily and make certain that you’re always correctly covered.

It’s also truly worth noting that the earth of coverage is continually transforming. New procedures, laws, and protection possibilities are introduced consistently. Maintaining with all of these adjustments may be time-consuming and complicated. Nonetheless, by in search of insurance policies guidance from an expert, you are able to remain educated about the most up-to-date traits and make sure you’re not lacking out on helpful solutions. Keeping up to date can help you make the top selections on your present and upcoming wants.

A further essential ingredient of insurance suggestions helps you to plan to the surprising. Daily life is unpredictable, and accidents can occur Anytime. When you can’t foresee the long run, you are able to put together for it with the ideal coverage. A proficient advisor will work along with you to discover likely risks and advocate procedures that may guard both you and your household. From unexpected emergency healthcare protection to everyday living insurance policy for family members, scheduling with the sudden makes certain that you won’t encounter economic damage in the event of an emergency.

Just one typical slip-up individuals make when searching for coverage tips is assuming which they don’t want Gain more info selected sorts of coverage. Such as, many children neglect the necessity of life insurance coverage as they come to feel invincible. Other folks could skip renters insurance policy, considering their belongings aren’t useful ample to insure. Nonetheless, mishaps, injuries, and unforeseen occasions can take place to any person, at any time. An insurance policy advisor will assist you to determine locations wherever you may well be underinsured and counsel coverage that can provide comfort.

The Definitive Guide to Insurance Consultation

For those who’ve ever felt puzzled by different phrases and jargon used in coverage contracts, you’re not by yourself. Insurance plan language can often seem to be a international language to the majority of people. Phrases like premiums, deductibles, copays, and exclusions can depart you Read all about it scratching your head. The excellent news is always that insurance policy assistance simplifies these phrases and will help you comprehend the things they suggest in sensible conditions. An advisor will stop working the advanced language, making it less difficult so that you can understand your policies and make effectively-knowledgeable conclusions.Insurance policies guidance doesn’t just give attention to Choosing the right plan; What's more, it can help you manage your protection eventually. As an example, you might start with primary automobile insurance policies, but as your life conditions alter, you may need to adjust your coverage. Your insurance policies advisor will likely be there to information you through daily life adjustments, encouraging you update your policies and guaranteeing you keep on to have the best defense. Normal Look at-ins can assist you steer clear of gaps in coverage and stop you from paying for unneeded extras.

Although some might Consider insurance policy is just needed for major daily life occasions, the reality is the fact that insurance plan is a protracted-expression commitment. It’s not a just one-and-finished process; it’s an ongoing connection using your insurance coverage provider. Through the years, your preferences will improve, and so will the guidelines accessible to you. With the correct insurance information, you’ll often have a person looking out for your very best interests, ensuring that you choose to’re hardly ever underinsured or overpaying for protection you now not need.

Insurance guidance also can allow you to get organized. Keeping observe of numerous insurance policies, due dates, and paperwork could be frustrating. A trusted advisor will let you keep an structured report of your respective insurance policy coverage, rendering it easy to evaluate your procedures whenever you should. Regardless of whether you might want to create a assert, update your protection, or just assessment your choices, acquiring an organized insurance policies portfolio will help you save you time and cut down stress.

Innovative Insurance Solutions Fundamentals Explained

As you think about insurance coverage solutions, keep in mind that you don’t really need to navigate this method by itself. With Learn more the correct suggestions, you’ll have a specialist by your side, assisting you make selections that align along with your economical goals and Life style. Insurance coverage is a Software to safeguard your long term, and with the right assistance, you’ll find a way To optimize its Added benefits. In spite of everything, securing your foreseeable future shouldn’t be a raffle—it should be a nicely-imagined-out plan.

In conclusion, insurance policy guidance is more than simply a luxurious; it’s an essential aspect of economic organizing. No matter whether you’re purchasing a house, starting a household, or preparing for retirement, possessing the proper coverage set up is important to your money protection. By working with an authority, you’ll be capable to navigate the earth of insurance coverage with assurance, figuring out you have the protection you would like when life throws unexpected issues your way. So don’t wait around—seek out insurance policy suggestions these days and be sure you’re totally coated for Regardless of the future holds.

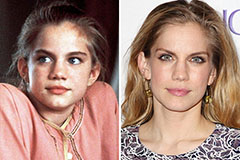

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now!